No Surprises Act – Medical Provider Compliance

Effective January 1, 2022

The No Surprises Act went into effect on January 1, 2022. Please note that this does not apply to beneficiaries or enrollees in federal programs such as Medicare, Medicaid, Indian Health Services, Veterans Affairs Health Care, or TRICARE.

This Act requires many things, which are discussed below. There are also examples towards the end of this that have certain helpful examples related to this Act.

Definitions

Ancillary services: items and services related to emergency medicine, anesthesiology, pathology, radiology, and neonatology, provided by either a physician or non-physician practitioner; items and services provided by assistant surgeons, hospitalists, and intensivists; diagnostic services, including radiology and laboratory services; and items and services provided by an out-of-network provider when there is no in-network provider who can provide the item or service at the in-network health care facility.

Balance billing: prohibits billing an individual for an amount that exceeds in-network limits on cost sharing and holding an individual liable for paying an amount that exceeds in-network limits on cost- sharing, and the individual can’t be put in the middle of a dispute regarding the total payment amount from the plan or issuer to the provider, facility, or provider of air ambulance services

In-network: a provider or facility that HAS a contractual relationship with a health plan or issuer for the item or service provided

Out-of-network: a provider or facility that DOES NOT have a contractual relationship with a health plan or issuer for the item or service provided

Overview

This Act prohibits out-of-network providers, facilities, or providers of air ambulance services from balance billing individuals more than their in-network cost-sharing limits in 3 main scenarios: (1) a person gets covered emergency services from an out-of-network provider or out-of-network emergency facility; (2) a person gets covered non-emergency services from an out-of-network provider delivered as part of a visit to an in-network health care facility; and (3) a person gets covered air ambulance services provided by an out-of-network provider of air ambulance services.

In some limited situations though, it allows some out-of-network providers and facilities to seek written consent (notice) from individuals to voluntarily waive their protection against balance billing.

Uninsured Patient

For patients that are uninsured, meaning that they are either “self-pay” or “cash pay,” a good faith estimate of expected charges must be given. This can be done by providing a fee schedule during intake paperwork and/or posting it publicly.

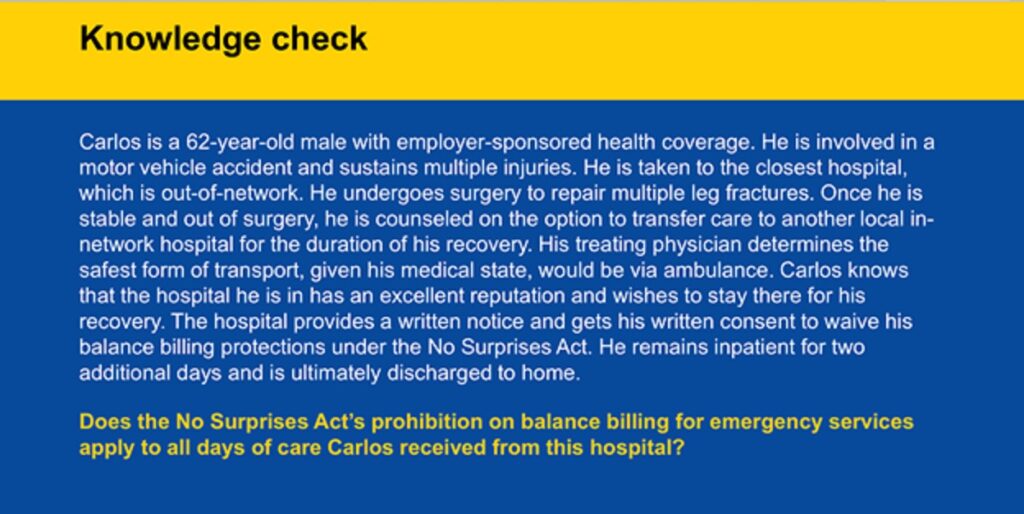

Out-of-Network Providers and Out-of-Network Emergency Facilities

Out-of-network providers and out-of-network emergency facilities (emergency departments of a hospital; hospitals; and independent, freestanding emergency departments) CANNOT balance bill for emergency services (includes medical screening examination to determine whether a medical emergency exists and any further medical examination and treatment that may be needed to stabilize the patient).

This applies to physicians and all other health care providers that are acting within the scope of their practice under state law (ex: Nurse Practitioner, Physician Assistant).

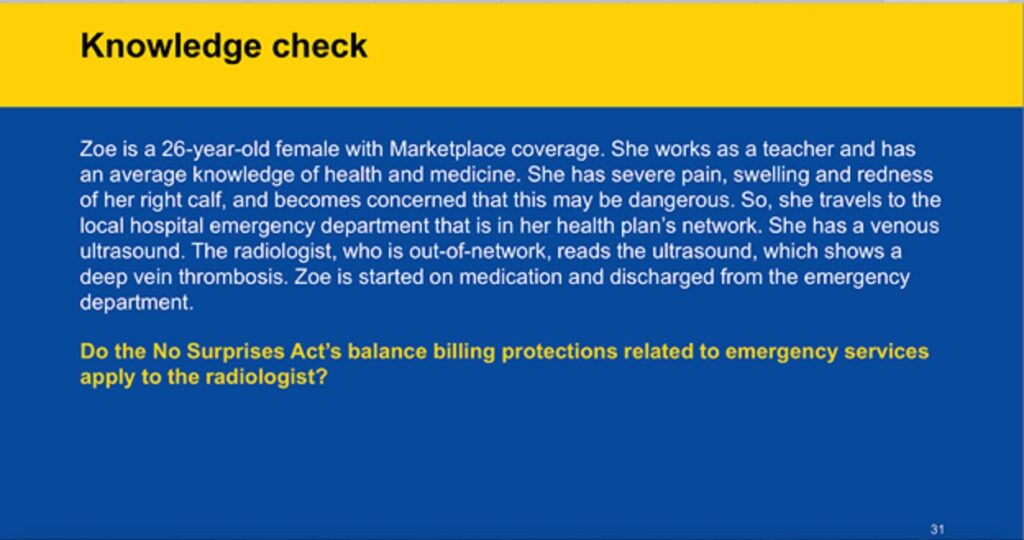

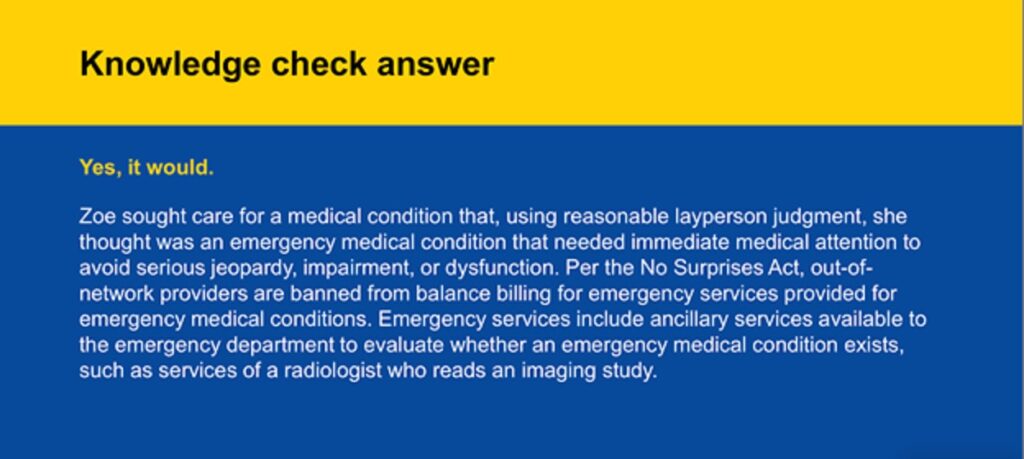

See Ex. 1 below.

Out-of-Network Providers at In-Network Health Care Facilities

Out-of-network providers at in-network health care facilities (hospitals, hospital outpatient departments, and ambulatory surgical centers) CANNOT balance bill an individual for non-emergency services. This prohibition on balance billing extends to equipment and devices; imaging services; telemedicine services; lab services; ancillary services; and preoperative and postoperative services.

This applies to physicians and all other health care providers that are acting within the scope of their practice under state law (ex: Nurse Practitioner, Physician Assistant).

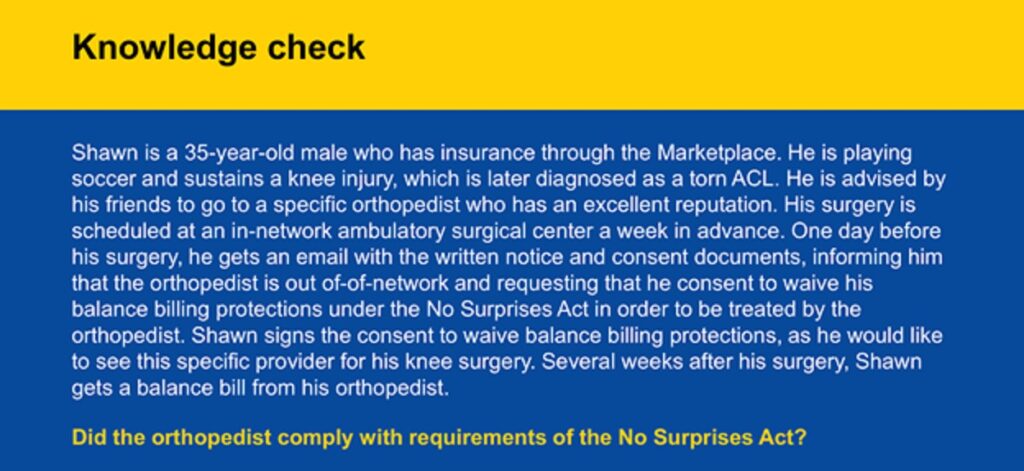

Notice and Consent to Waive Balance Billing

Under certain circumstances, which are below in infographics, a provider/facility may use a notice and consent form to waive balance billing protections. However, the patient must consent to this and voluntarily waive their balance billing protections.

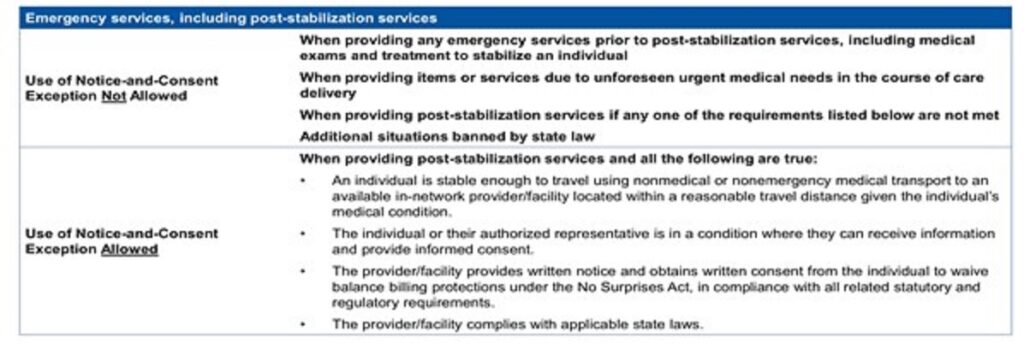

For emergency services, refer to this to determine if balance billing is allowed (see Ex. 2 below):

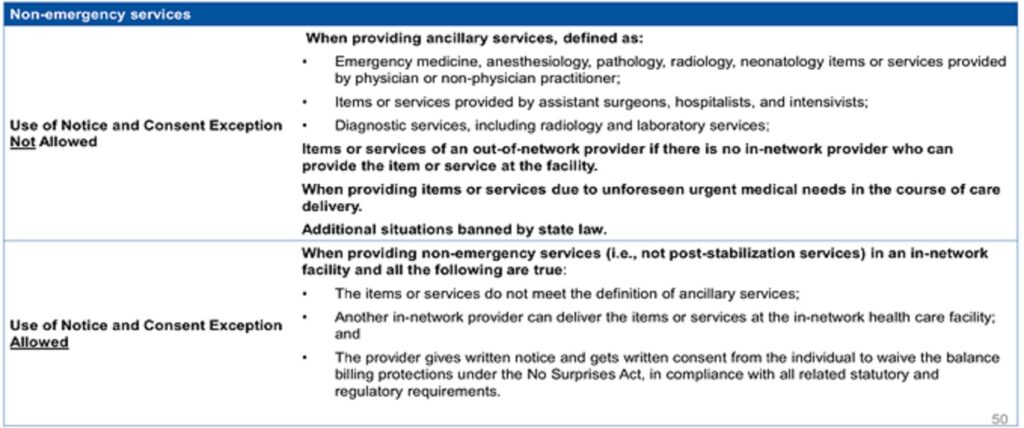

For non-emergency services, refer to this to determine if balance billing is allowed (see Ex. 3 below):

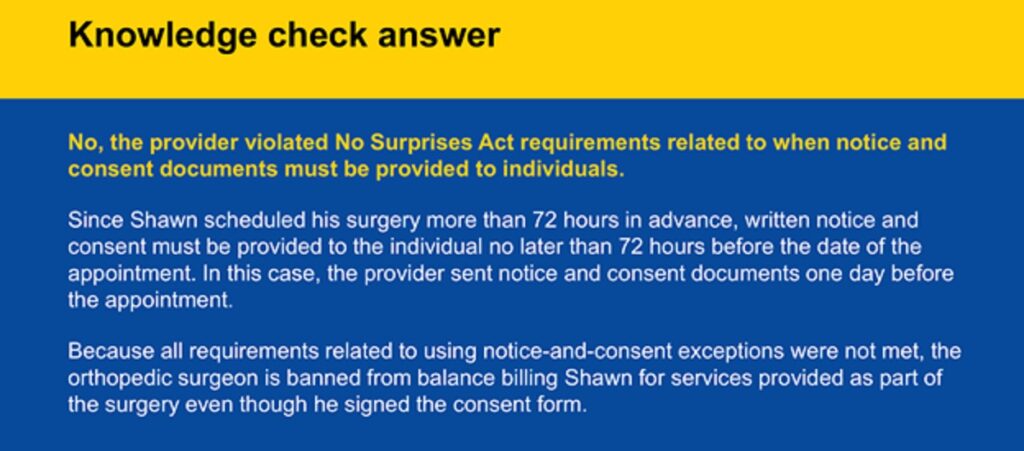

When giving notice and seeking waiver from balance billing, providers and facilities must use this standard notice and consent developed by HHS. The exact timeframe of when to provide this notice is as follows (see Ex. 4 below):

| When the appointment was made: | When to provide notice: |

| 72 hours prior | 72 hours prior |

| Within 72 hours | Day the appointment is scheduled |

| No later than 3 hours prior if the patient is provided the notice and consent documents on the day the items or services are to be furnished |

Example 1: OUT-of-Network Provider Providing EMERGENCY Services

Example 2: When Balance Billing CANNOT Be Waived

Example 3: When Balancing Billing CANNOT Be Waived

Example 4: Timeframe of When to Provide Notice for Balance Billing Waiver

General Counsel Packages

We offer General Counsel packages on three different tiers – all for a flat-fee price! Covering items such as unlimited consultations to contract negotiations and drafting/editing, the General Counsel packages are something to consider for your healthcare business. To learn more about these packages, click the clink below!